-

Bohaterstwo, które podziwiał świat. „W..

POLSKA2 lata temu -

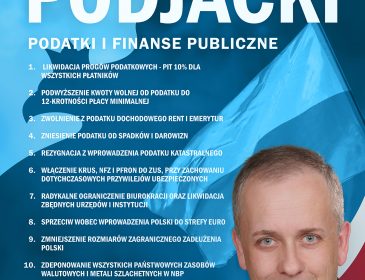

Neon24 – ruska V kolumna

POLSKA3 lata temu -

Nowe osoby w Zarządzie Amiblu

BIZNES3 lata temu -

Mechanizm warunkowości – krok ku Homo Eu..

POLSKA3 lata temu -

Wściekłe i wulgarne „Lemparcice” ..

POLSKA4 lata temu -

Rolnicze poparcie dla prezesa Elewarru – ..

NEWS4 lata temu -

Bohaterstwo, które podziwiał świat. „W..

POLSKA2 lata temu -

Neon24 – ruska V kolumna

POLSKA3 lata temu -

Nowe osoby w Zarządzie Amiblu

BIZNES3 lata temu -

Mechanizm warunkowości – krok ku Homo Eu..

POLSKA3 lata temu -

Wściekłe i wulgarne „Lemparcice” ..

POLSKA4 lata temu -

Rolnicze poparcie dla prezesa Elewarru – ..

NEWS4 lata temu -

Bohaterstwo, które podziwiał świat. „W..

POLSKA2 lata temu -

Neon24 – ruska V kolumna

POLSKA3 lata temu -

Nowe osoby w Zarządzie Amiblu

BIZNES3 lata temu -

Mechanizm warunkowości – krok ku Homo Eu..

POLSKA3 lata temu -

Wściekłe i wulgarne „Lemparcice” ..

POLSKA4 lata temu -

Rolnicze poparcie dla prezesa Elewarru – ..

NEWS4 lata temu -

Bohaterstwo, które podziwiał świat. „W..

POLSKA2 lata temu -

Neon24 – ruska V kolumna

POLSKA3 lata temu -

Nowe osoby w Zarządzie Amiblu

BIZNES3 lata temu -

Mechanizm warunkowości – krok ku Homo Eu..

POLSKA3 lata temu -

Wściekłe i wulgarne „Lemparcice” ..

POLSKA4 lata temu -

Rolnicze poparcie dla prezesa Elewarru – ..

NEWS4 lata temu

The Banker: ICBC bond issue helps BarCap strengthen its Asia ambitions

When China’s biggest bank, ICBC, launched its first dollar bond issue, it offered investors a rare opportunity of direct exposure to the mainland banking system.

There was no shortage of interest. Along with UBS and ICBC’s own investment arm, Barclays Capital landed the role of global co-ordinator, helping BarCap cement its Asian standing.

Equity markets may be taking a dim view of them right now, but for fixed-income investors there is something mesmerising about a big Chinese bank. In spite of worries over their lending, they are a proxy for Chinese government risk and, in an uncertain world, you don’t get much safer than that. So the first ever dollar bond offering from China’s biggest bank was positively gobbled up by international investors, including an unusually high percentage of insurance companies.

At the end of November, Industrial and Commercial Bank of China (ICBC) priced a $750m, 10-year bond paying a 4.875% coupon. As well as being its first dollar issue, it was the largest international offering to come from ICBC or any of its subsidiaries. But what also made it something of an event was that the A1/A senior unsecured paper was guaranteed by ICBC’s Hong Kong branch. As such, it was a rare opportunity for investors to gain direct exposure to a mainland bank, rather than one of its offshore subsidiaries.

Biding its time

In China, capital market deals are prepared in the school of slow cooking rather than fast food, and ICBC had been contemplating this one, going backwards and forwards with the authorities since early 2011. It was August before the call went out to would-be advisors. This was a deal that any respectable investment bank wanted to be a part of and competition for the mandates was energetic. The roles of joint global coordinators eventually went to Barclays Capital, UBS and ICBC’s own investment bank, ICBC International.

This was a testament to Barclays Capital’s progress in Far Eastern markets, from a standing start. Its presence in Asian investment banking has been palpable only for the past three years, since the acquisition of Lehman Brothers’ US business gave it some regional gravitas, and it has been pushing for growth on all fronts.

ICBC, with its A1/A rating, is one of China’s most highly rated banks. As a predominantly commercial institution, it relies on deposits for about three-quarters of its funding, complemented by very short-term wholesale financing and a certain amount of domestic subordinated debt issuance. Its last notable transaction in the international capital markets was its initial public offering in 2006. In global debt securities markets, China and its banks only rarely heave into view. The last outing from the People’s Republic of China was in 2004, when it raised $1bn and €500m. China Development Bank, one of China’s three 'policy’ banks, raised $1bn in 2005. Since then, neither the government nor the financial sector has borrowed offshore other than in offshore renminbi. There have been some deals from offshore bank subsidiaries, but these have not provided direct exposure to the onshore banking sector.

Global expansion

ICBC’s decision to tap the international markets was prompted by a very specific need. “The transaction was driven by ICBC Leasing, a wholly owned ICBC subsidiary which is active domestically and, increasingly, internationally,” explains Jon Pratt, Barclays Capital’s head of debt capital markets (DCM), Asia.

Unrated ICBC Leasing will use the proceeds to help finance its international expansion, principally by purchasing airplanes. While it is also active in container and large equipment leasing, its non-domestic growth is mostly driven by aircraft leasing. Like most things Chinese, this links back to Chinese economic policy. “We expect to see continued strong growth in the leasing sector, supported by government policy to drive growth within the overall Chinese aviation industry,” says Nina Zhou, a managing director in Barclays Capital’s financial institutions group, Asia-Pacific.

ICBC Leasing, established in 2007, has strategic partnership agreements with most of the major domestic airlines, and is now targeting regional and international carriers. It has a fleet of 70 planes, though recent orders will more than double that. “Leasing companies depend on wholesale financing for growth and, historically, they are frequent issuers in the bond market, which plays to Barclays Capital’s strengths,” says Ms Zhou.

Various Barclays Capital teams were mobilised to work on the transaction, including DCM, risk management and ratings. They worked with ICBC Leasing to evaluate different market options, maturity and issue amounts, concluding that the dollar market offered the most flexibility and deepest demand for maximum capital market impact. One inspired move was to sound out the possible interest of Taiwanese insurers, who had only recently been permitted to invest in Chinese bonds for the first time.

“We organised a visit by several Taiwanese insurance companies to meet the bank and regulators in Beijing,” says Philip Tsao, Barclays Capital head of global finance and risk solutions, Greater China. “That got them more comfortable with the idea of buying Chinese paper.”

At this presounding stage, all that had been decided on was that the transaction would be benchmark-sized and denominated in dollars. Actual size and maturity would depend on investor appetite, and the positive response of the Taiwanese insurers was helping to tilt the balance in favour of a longer tenor.

Fixed-income focus

The original plan had been to get to market before the end of October, but for much of that month the eurozone crisis was going from bad to worse and markets were yo-yoing wildly. At the start of November, the teams began a week-long roadshow for fixed-income investors in Hong Kong, Singapore and – even though almost all the deal ended up with Asian investors – Geneva, Zurich and London. “London is a must-have stop for any DCM Reg S deal, and European investors tend to prefer long maturities,” says Ms Zhou.

ICBC Leasing’s senior management was on the roadshow, including its CEO, CFO, head of capital markets and head of aircraft leasing, along with the head of investor relations from ICBC itself. Questions were split between the leasing business, the bank and the banking sector, and covered issues such as the economy, exposure to local government finance and prospects for non-performing loans.

The ICBC view was that the economy was headed for a soft landing, with both a continued decline or a hockey-stick scenario unlikely. Non-performing loans were being managed down and the bank’s exposure to local government borrowers was limited, and confined to the less risky, more urban and commercial bodies.

On the front foot

The deal was eventually launched when an issuance window opened at the end of November, laying emphasis on the quality of the name and its rating. In fact, until the day of the launch ICBC enjoyed Standard & Poor’s only A rating in Chinese banking, before S&P upgraded Bank of China and China Construction Bank to the same level, even as it downgraded Bank of America, Goldman Sachs and Citi by a notch to A-.

ICBC was determined to overflow the order book and priced the A1/A rated 10-year transaction accordingly. The bookrunners, who now included HSBC and Standard Chartered, went out with price guidance of Treasuries plus 320 basis points (bps). Without the Hong Kong branch guarantee, the price would have had to be even more generous. “The process was very swift and smooth,” says Jennifer Zhang, a director in Barclays Capital DCM, Asia. “The order book attracted bids of $2.25bn from approximately 160 accounts, with strong participation from buy-and-hold investors. We priced the same day at 310bps over.”

Allocation of the $750m deal favoured buy-and-hold investors and a full 33% went to Taiwanese and regional insurers, with banks taking 29%, fund managers 25% and private banks 8%. It also heavily favoured Asian investors, who accounted for 95% of geographical distribution.

“The significance of the deal is that it is the first time investors have had the opportunity for exposure to the onshore Chinese banking system in more than six years,” says Mr Pratt. “And this is as close a proxy as you can get to government, in terms of what’s currently liquid and available.”

It also signals that more Chinese banks will be looking outside their domestic market for sources of capital, which – given that they are now largely lending to each other – would be no bad thing.

By Edward Russell-Walling

„The Banker”

Wiadomości z banków i o bankach, dla klientów i pracowników, entuzjastów i sceptyków. Ubezpieczenia od A do Z. Gospodarka, finanse i giełda.

Jeden komentarz